"Portable Wi-Fi" Review

25/03/2022

When starting a startup, funding for operation is one of the important factors. There are various methods of raising funds, but they can be roughly divided into three types. Each of these three types has different characteristics, advantages and disadvantages. Based on them, it is better to choose the method that suits your company.

This time, I will explain how to raise funds for startups.

*In the "Founding Techo" where I am writing this article, more detailed information is also explained in the thick "Founding Techo / Printed Edition". You can get it for free, so please order it.

Contents of this article

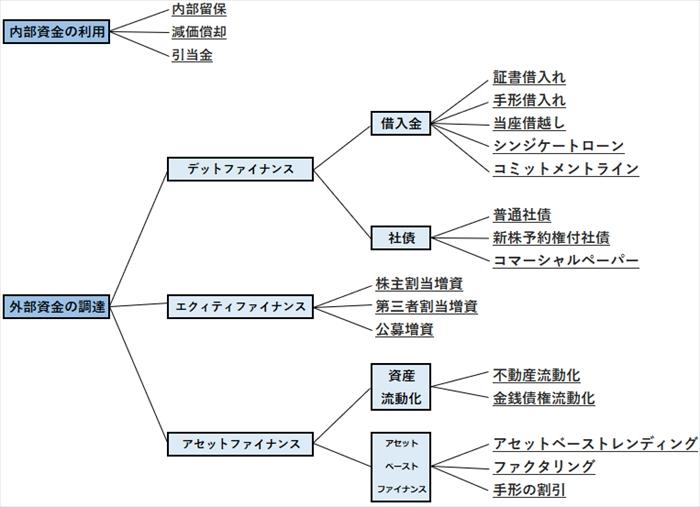

Most of the fundraising methods can be roughly divided into the following three types.

The method of selling the company's assets and receivables and allocating the proceeds to funds is called asset finance.

The assets and receivables to be sold here are excluded from the balance sheet on the assumption that they will be sold, and are not recorded as assets and receivables (off balance). Owning assets and receivables entails the risk of incurring liabilities for the company, so a sound financial situation can be expected by taking these off the balance sheet.

A common way to raise funds is to take a loan, and this method is called debt financing. If you're new to a startup and don't have any assets or bonds to sell, you'll have to find a way to get financing. There are various types of lenders, and each lender conducts a loan screening, so it is not always possible to raise funds.

In addition, you should consider not to put pressure on your cash flow, including the repayment of the loan amount and interest.

This is a method called equity financing, where shareholders can obtain funds by purchasing shares issued by a company. When a company raises funds through issued shares, it can be accounted for as capital of the company. Investors buy shares based on the company's creditworthiness and growth. However, the credibility of a newly launched startup is weak and the growth rate is unknown.

Venture capital and angel investors, which will be described later, back up such startups and support their growth.

Specific examples of financing methods classified into asset finance, debt finance, and equity finance are mainly as follows.

Asset finance can be subdivided as follows.

The tangible or intangible assets of a company are sold and liquidated. The main types of asset sales are:

・Movable property, real estate We will sell movable property or real estate that does not directly affect the actual business. I will give representative examples of each.

* Movable property securities Golf and membership rights of various facilities Automotive trademark rights, various rights such as intellectual property rights, etc.

*Idle land for real estate Company housing, dormitories, training facilities

・In surplus inventory asset finance, there is also a method to sell surplus inventory that does not lead to sales. Originally, inventory is considered an asset because it leads to future sales. However, if the inventory is not sold and accumulates, it will be a loss in accounting and will put pressure on profits. Therefore, the idea is to sell surplus inventory as an asset.

Receivables refer to things that should be deposited in the future, such as accounts receivable and bills receivable. And liquidating and selling these receivables is a way to quickly raise funds. Securitization of receivables is subdivided into three types.

・FactoringIn factoring, you can quickly cash the corresponding amount by selling your receivables to a factoring company. However, in order to carry out factoring, the creditworthiness of the company will be examined, and a fee will be collected according to the result. The debtor business partner pays the relevant amount to the factoring company on the original payment date.

・Accounts receivable held by an accounts receivable securitization company is transferred to a company called SPV (Special Purpose Vehicle) that specializes in securitization of receivables, and the securities are used as investment targets. increase. In other words, by securitizing the receivables, the company can receive the amount invested in the securities as funds. However, even when securitizing accounts receivable, the creditworthiness of the company is questioned.

・ABLABL (Asset Based Lending) is a term that indicates accounts receivable collateralized financing, and it is a method of receiving a loan of an appropriate amount using the value of accounts receivable as collateral. This is also counted as securitization of receivables, but it is classified as debt finance in terms of nature, so it will be explained later.

Debt financing is a way to take on some debt and raise money quickly in exchange for it in five ways:

It is common for start-ups and other companies of all sizes to get a loan from a bank. Bank loans may or may not have a guarantee.

・Guarantee Here, startups and SMEs with low social credibility can receive loans with the credit of financial institutions by being guaranteed by a guarantee company (Guarantee loan). If the company passes the examination, it will be easier for the company to obtain loans from the bank, and the bank will also be able to avoid the risk of bad debt.

However, a two-step examination by a credit company and a financial institution is required.

・Non-guaranteed Bank loans include direct transactions between financial institutions and companies without guarantees (proper loans). With this method, there are no fees charged to the credit company, and there is often no maximum loan limit.

However, it is a difficult road for startups because the company's creditworthiness and business conditions are strictly screened.

In addition, there is ABL (accounts receivable collateralized loan) mentioned above as a method of receiving a loan from a financial institution. This is a method of providing loans using assets such as accounts receivable and surplus inventory as collateral. Loans are provided based on the evaluation of each collateral, so there is no need to attach guarantees, etc., but it is necessary to make the management status of the collateralized assets transparent.

The Japan Finance Corporation, wholly owned by the government, was established to support the businesses of small and medium-sized enterprises, including startups. We keep the loan conditions and interest rates low, and have established many systems that make it easy for startups to receive loans. In addition, the response is generous, such as setting a period for measures in the repayment plan.

Some local governments also have financing systems for startups. In this case, it is possible to obtain a loan at a relatively low interest rate. Regarding the examination, it is necessary to pass both the municipality and the credit company, and the conditions are different for each municipality, so confirmation is necessary.

If it is difficult to get a loan from a financial institution, for example because your social credibility is low or you cannot pass the examination of a credit company, There is also a method to make a loan at a financial institution depending on the method.

・Business loans Business loans are mainly provided by banks and consumer finance, and can be borrowed without a guarantee. In addition, the conditions for screening by financial institutions are often set low. However, you should be cautious when using it, as interest rates often increase as much as it is easy to borrow, and it may be difficult to pay interest rates after raising funds.

・Real estate collateral loan For loans from financial institutions, there is also a method of arranging a loan with real estate as collateral. This is also a system such as a bank or consumer finance, and the borrowing amount is determined by the real estate appraisal value. The market price of the loan amount is generally around 70% of the appraised value of the real estate secured.

You can also borrow cash from your own relatives and use it for funds. In this case, since trust is maintained to some extent as a human relationship, there is no need for an examination, and it is possible to decide the terms of the loan through consultation, making it a method that can be easily selected.

However, because of the close relationship, there are many cases where clear conditions such as repayment deadlines and interest rates are not set, and this often leads to financial troubles.

Equity financing, which raises assets by increasing the capital of a company, mainly employs the following methods.

This is for investors to purchase stocks and bonds issued by the company. There are several ways to issue stocks and bonds.

・For publicly offered stocks and corporate bonds, we invite general investors to purchase them. So to speak, it is a general stock investment method. When investing in stocks and corporate bonds, the market price can be attached to the issuance of new stocks, and when the stock price is rising, a small amount of funds can be issued.

・Shareholder allotment This is to allocate new shares according to the number of shares to investors who are already shareholders and encourage them to purchase. In many cases, new shares are priced below market value, which is also beneficial to shareholders.

・Third party allotment This is a method of issuing new shares to specific business partners other than the company or shareholders and having them purchase them. This method is also effective for strengthening ties with business partners.

・Convertible bond type bonds with subscription rights to shares Among the bonds, bonds that can be converted into shares are issued and investors purchase them. The amount to be converted from stocks to bonds is set in advance, and when the stock price exceeds the set amount, there are benefits for investors as well.

Venture capital is a company that invests in and backs up startups and venture companies that are expected to grow in the future, and earns profits by improving the performance of the investee company. . Investing from venture capital is advantageous in that it is possible to raise funds quickly and at a large amount, and that you can receive support for management and financing.

However, in order to be certified as a company that is beneficial to venture capital, a solid business plan and innovative ideas are required.

While venture capital is a company, angel investors are individuals. In terms of the nature of investment, it is similar to venture capital, investing in startups and venture companies that can be expected to grow and earning profits for investors based on business performance.

Many of the angel investors are well versed in management, so they can also receive management support.

The three categories of financing mentioned above have different advantages and disadvantages.

・Effective by selling assets that are not involved in the company's business or assets that are not involved in the company's assets can be utilized. This will help you get rid of wasted assets.

・Being able to cash out useless assets that have the potential to improve management by converting receivables into assets is not only useful for fundraising, but it is also possible to make the management situation smarter by taking assets off the balance sheet. .

・By long-term holding of assets that can prevent declines in asset value, etc., there is also the risk of a decline in the market price and the creditworthiness of the company to which the company is receivable. However, by selling the asset early, you will receive the proceeds of the sale before the value declines.

・If you don't have assets, you can't use it. , If you don't have assets in the first place, you can't sell them.

・It is difficult to utilize on the scale of the sole proprietorship class.In particular, when the business scale is small, such as startups and sole proprietors, they often do not have assets that can be sold. This makes it difficult for small businesses to use this method.

・When you receive a loan from a financial institution that allows interest to be deducted, you need to pay the interest. You can write off the interest as a loss.

・The interest recorded as a deductible expense as described above, which can be expected to have a tax saving effect, will be deducted from the income of the year. As a result, you can reduce your income as a result, and it will also be a tax saving measure for income tax.

・If you pay off the loan amount, your creditworthiness will increase. No matter what kind of financial institution you receive a loan from, paying it off will improve your social credibility. As a result, it may be easier to pass the screening of financial institutions from the next time onwards.

・With a loan that requires you to repay the amount you received, you will have to repay the loan amount every month, which may affect your cash flow. . It is important to carefully consider your repayment plan.

・The capital adequacy ratio that puts pressure on the capital adequacy ratio is the ratio of capital that does not need to be repaid to the total capital. In other words, if a company receives a loan that must be repaid and increases its capital, it will put pressure on the capital adequacy ratio. In general, if the capital adequacy ratio is low, it is considered that the company is conducting unstable management, and social credibility declines.

Contrary to the above, it is a method of raising funds that does not require repayment. Therefore, it is possible to increase the capital adequacy ratio and improve social creditworthiness.

・No repayment obligation As mentioned above, there is no repayment obligation as we raise funds by issuing stocks and bonds. Therefore, it will be financially beneficial without putting pressure on cash flow.

・This method of transferring voting rights to shareholders will result in the issuance of a large number of shares, and in the form of transferring the voting rights at the general meeting of shareholders by the purchased shareholders. is. As a result, there is a risk that even management rights will be transferred to a third party.

・Issue too many shares and the value drops If you issue a lot of new shares just because you want to get a large amount of money, many of the existing shares will be on the market, which will lead to a decline in the stock price. .

As mentioned above, there are three main types of fundraising methods. increase.

Crowdfunding is a method of collecting funds for your own business, products, and services from an unspecified number of people via the Internet. Investors can easily invest from a small amount with the feeling of supporting the business, and startups who are drafters can receive investment without high hurdle conditions.

It is a low-risk method for both investors and drafters, but it is necessary to obtain strong support from general investors in order to receive investment.

In addition to loans, some local governments have subsidies and subsidy systems. Since it is not a loan, there is basically no obligation to repay, making it a welcome system for startups and SMEs.

There are certain conditions to receive these, but the hurdles are low and easy to use. It should be noted that the conditions differ depending on the municipality and the application period is limited.

In recent years, ICOs (Initial Coin Offerings), which raise funds and invest in virtual currencies, have emerged. While it offers a high degree of freedom in transactions, it carries the risk of being used as a means of fraud.

The amount of funding a startup can raise against its own capital will greatly affect its future management. Some of the three types of fundraising methods introduced here are suitable for startups, but it is important to remember that they have both advantages and disadvantages.

In recent years, in addition to the three main funding methods, there are other effective ways to raise funds. However, it does come with some risks, so be careful when choosing a method.

The booklet version of the founding notebook introduces a method of raising funds that is beneficial for newly established startups and companies that need additional funds. If you are looking for a way to raise funds, please refer to it. Related article7 points for creating a business plan that enables fundraising [Mr. Okubo, founder of Founding Techo, explains the basics of fundraising that can't be heard now(Edited by Founding Techo Editorial Department)

Articles that everyone is reading in this category 1st cash flow [a must-see for managers! ] We have summarized the new corona support system that can be used now-Introducing examples of use Second place What is a cash flow business plan? 4 advantages, points to note, and how to write! A business plan is a key to success in starting a business and raising funds. Dangerous? Explains from membership qualification to cancellation method, merits and demerits!