"Portable Wi-Fi" Review

25/03/2022

Social welfare corporations are one type of legal entity, and are often seen in welfare service companies. It is a non-profit organization for the purpose of social welfare, which is the operating body of medical care, nursing care, and welfare services.

If you are considering starting a business such as a support facility for the disabled or a nursing home for the elderly, you should understand social welfare corporations. To become a provider of such welfare services, it is essential to establish a social welfare corporation. By becoming a social welfare corporation, there is preferential treatment and social credibility. For entrepreneurs aiming for welfare business, we will explain what kind of organization a social welfare corporation is, what is the difference from a stock company, the conditions for establishment, and the merits and demerits.

*In the "Founding Techo" where I am writing this article, more detailed information is also explained in the thick "Founding Techo / Printed Edition". You can get it for free, so please order it.

Contents of this article

Social Welfare Corporations are private organizations that provide social welfare services. It can be established based on the Social Welfare Act, which was enacted in 1951 and completely revised in 2000. Social welfare services can also be operated by joint-stock companies, but social welfare corporations and joint-stock companies differ in terms of service content and management rules.

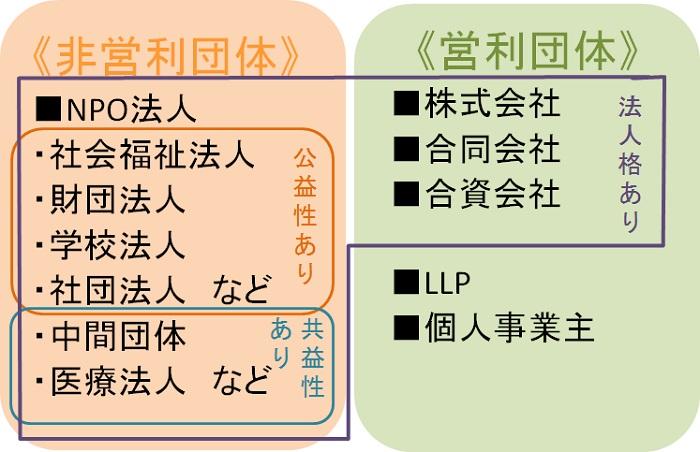

Social welfare corporations are a type of legal entity such as a stock company, a medical corporation, and an NPO corporation, and are private organizations. Among them, it is one of the many management bodies in the fields of medical care, nursing care, and welfare business. Social welfare corporations are private organizations, but they are also non-profit organizations.

Social welfare corporations are non-profit private organizations that are established for the purpose of welfare projects. Medical corporations are established for the purpose of medical care, and social welfare corporations are established for the purpose of social welfare. Each corporation has its own purpose.

Establishment for the purpose of social welfare work is defined in the Social Welfare Law, and this rule cannot be broken. In order to become a social welfare corporation, it is necessary to conduct business that is recognized as a social welfare business as stipulated by this law. In addition, approval is required for establishment.

Social welfare corporations are private organizations, but unlike corporations, there are restrictions on service content. A joint-stock company can operate for profit, but a social welfare corporation cannot operate for profit. Although both corporations and social welfare corporations have the same legal personality, there are differences in various aspects, including the degree of freedom for business purposes.

The table below summarizes the differences between corporations and social welfare corporations.

| Corporation | Direct employment (such as office workers) | Social welfare corporation | Business Purpose | Freedom | Employment Contract | Social Welfare Service |

|---|---|---|---|

| Establishment Required number | 1 or more | Determined | 6 or more directors, 2 or more auditors, more than twice as many councilors as directors< /td> |

| Funds | Equity/Bond Issuance | Fixed/Stable | Donations, Subsidies |

| Corporate Tax | Taxation | From Employer | In principle tax exempt (income arising from income events is taxable) |

| Disposal of residual assets | Distribution to shareholders after debt repayment | Employee training/provided and subsidized by employer | According to the stipulations of the proposal, property that should belong to the person who should belong to it belongs to the national treasury |

The social welfare business of social welfare corporation Also includes business, profitable business. However, the business is not "for profit" to the last, and the main business is only for the purpose of social welfare. In addition, public utility projects are limited to those related to social welfare, and the income earned from profit-making projects is used for the operation of social welfare projects. Furthermore, compared to a joint-stock company, requirements such as the number of people required at the time of establishment and the number of officers to be appointed are strictly stipulated.

On the other hand, however, the social welfare services provided by social welfare corporations are tax exempt in principle. It is taxed only when the business is profitable.

Social Welfare Corporations were established by the Social Welfare Corporation Business Act (which was completely revised to the "Social Welfare Act" in 2000). Furthermore, in order to circumvent Article 89 of the Japanese Constitution, which ``prohibits the expenditure of public funds on charitable or philanthropic projects not under public control'', the ``social welfare corporation system'' was institutionalized.

With the promulgation of a law to partially revise the Social Welfare Law, etc., which was enacted on March 31, 2016, the social welfare corporation system has been reviewed in the following points.

By institutionalizing and reviewing social welfare corporations, it is expected that the public interest and non-profitability of social welfare corporations and the transparency of their business will be enhanced.

Social welfare corporations are organizations that carry out social welfare services based on the management principles of Article 24 of the Social Welfare Act. Organizations that do not primarily engage in social welfare projects cannot become social welfare corporations. So what exactly is social welfare work? We will explain the outline of social welfare business and the business that social welfare corporation can do.

Social welfare services that social welfare corporations can carry out are divided into "Type 1 social welfare services" and "Type 2 social welfare services." Among them, Type 1 social welfare services can only be carried out by social welfare corporations, the national government, and local public bodies. On the other hand, Type 2 social welfare work is a social welfare work, but even if it is not a social welfare corporation, it can carry out the business if it is notified.

The main projects and facilities of Type 1 social welfare services are as follows. Each business is conducted in accordance with relevant laws.

| Public Assistance Law | Management of relief facilities, rehabilitation facilities, and other facilities aimed at providing livelihood assistance by admitting people with financial difficulties free of charge or at a low cost | |

|---|---|---|

| Child Welfare Law | Infant care facilities for maternal and child living support facilities for children with disabilities Facility short-term treatment facility for emotionally disturbed children or child self-reliance support facility Nursing Home Management Business | |

| Law for Comprehensive Support for Daily and Social Life of Persons with Disabilities | Management of Support Facilities for Persons with Disabilities | |

| Anti-prostitution law | Business to run a women's protection facility |

Second The main contents of the seed social welfare project are as follows. Type 1 social welfare services mainly consisted of in-home services, while type 2 services consisted mainly of commuting services and at-home services.

| Child Welfare Law | After-School Nursery School Child Health Development Project Single Mothers and Widows Welfare Act | Daily Life Support Projects for Motherless Families |

|---|---|---|

| Elderly Welfare Act | Day Service Projects for Dementia Elderly communal living assistance project Small-scale multi-functional in-home nursing care project Projects | |

| Act on Welfare of Persons with Disabilities | Life training for persons with disabilities Sign language interpreting service Service dog training Hearing dog training | < /tr>

Social welfare corporations must be social welfare businesses as their main business, but they can also engage in public works and profit-making businesses. However, when conducting public works or profit-making projects, it is necessary to comply with the prescribed requirements.

Main requirements for doing public works

Main requirements for operating a profitable business

The main function of social welfare corporations is to conduct social welfare projects, and the above projects are only sub-projects. In addition, for revenue-generating businesses, the usage of the revenues obtained is also determined.

In social welfare corporations, the three functions of decision-making, business execution, and auditing are distributed to each organization. The decision-making body is the Board of Trustees. The Board of Trustees makes decisions on important corporate management matters and appoints and dismisses directors and auditors.

It is the president who executes business as a representative of the corporation. The Chairman is elected and removed by the Board of Directors. The board of directors is an organization that makes decisions on business execution and supervises the execution of duties. Furthermore, the auditor is the organization that audits the execution of duties by the directors. Accounting auditors are assigned to corporations above a certain size.

The Board of Trustees is an organization that determines the basic rules and systems for operating a social welfare corporation, and is an organization that supervises the management of the corporation. In addition to appointing and dismissing officers, decisions on officer remuneration and amendments to the Articles of Incorporation can also be decided by a verdict. In addition, we have a delegation relationship with a social welfare corporation and follow the duty of care of a prudent manager and liability for damages. In other words, it is an administrator entrusted with the management of a social welfare corporation, and is an important position that must be held responsible if damage occurs due to the duty of care.

The establishment of the Council is stipulated in Article 36 of the Social Welfare Law. Article 39 also stipulates that "a person who has the insight necessary for the proper operation of a social welfare corporation". In addition, it is not possible to serve as an officer or an employee of the social welfare corporation. In order to maintain the public interest of the corporation, persons who have a special interest in certain trustees or officers may not be trustees.

The number of councilors is more than twice the number of directors specified in the Articles of Incorporation, and since the social welfare law stipulates that the number of directors must be 6 or more, a larger number is required.

The requirements for obtaining authorization to establish a social welfare corporation are as follows.

・Name Person names and facility names must not quote individual or group names. The legal entity name and facility name must be different.

・At least 6 directors and 2 or more auditors will be installed.

・Establishment of councilors and board of councilors Based on the above rules, we will appoint councilors and establish a board of councilors.

・Asset requirements In principle, basic assets of 100 million yen or more are required as a management base.

Funding requirements It is necessary to prepare the necessary amount of corporate administrative expenses such as working capital and construction costs.

・It is necessary to meet the requirements that there is a gift contract in writing at the time of establishment of the corporation, and that it can be proven that the donation will be made reliably.

・Borrowing at the time of incorporation If you are planning to borrow for construction funds, etc., you need to make a redemption plan.

・Articles will be created in accordance with the Articles of Incorporation of the Social Welfare Corporation.

Social welfare corporations are different from stock companies in many aspects, and while they are strict, they are also treated favorably. Let's compare the merits and demerits of social welfare corporations and consider whether it is better to establish a social welfare corporation or adopt a different form when conducting social welfare projects.

The benefits of social welfare corporations are special assistance and preferential treatment. There are many things that other corporations cannot obtain, and you can start your business under more favorable conditions.

Social welfare corporations can receive a certain amount of subsidy for facility maintenance. There are subsidies for businesses of other private organizations and individuals, but subsidies for social welfare corporations are richer and more expensive than others. Subsidies are more important when you are planning a business of a certain size or when you need substantial equipment.

As mentioned in the comparison with corporations, the main business of social welfare corporations is tax-free. Preferential measures are taken in terms of taxation as a business with high public interest.

However, if you do a profitable business as a sub-business, the income is taxable. At that time, the reduced tax rate will be applied to the income related to the profit-making business.

Social welfare corporations are highly reliable due to various preferential treatment, strict standards, and complex monitoring systems, and are expected to have stable management. Also, the benefits are often better than other companies. Therefore, it is easy to gather excellent staff, and it is possible to enhance human resources. In addition, since the treatment is enhanced, the turnover rate will be low, and you will be able to focus on human resource development.

Social welfare corporations are given preferential treatment in many ways, but they have a low degree of freedom in business and are difficult to manage.

Social welfare corporations have strict conditions for establishment and operation, and sometimes I feel that management is more difficult than a stock company. If you do not meet the requirements, you cannot receive approval, and the conditions that must be met, such as the number of officers, are determined in detail. In addition, the method of raising funds is only donations and subsidies, and shares cannot be issued.

In the case of a joint-stock company, it is not so strict, and even one person can establish a one-person company, and there is no rule as long as the capital is 1 yen or more. Also, you can start running your business without needing to obtain a license.

Social welfare corporations have strictly defined main business contents. Also, there are limits to what you can do. Therefore, it is impossible to freely develop business, and people who are considering business for profit cannot establish a social welfare corporation in the first place.

I will explain the procedure for establishing a social welfare corporation along the flow. In order to establish a social welfare corporation, it is necessary to apply for approval. Let's check how to apply for approval, the procedure after that, and the required documents.

When establishing a social welfare corporation, it is common to consult with the welfare general affairs section of the local government in advance. At the same time, we will prepare facilities and equipment, set up a preparatory committee to prepare for establishment, and elect officers. The Preparatory Committee for Establishment is an organization organized by those who plan to establish the establishment.

In order to obtain establishment approval, it is necessary to prepare the Articles of Incorporation. Where to seek approval will depend on the size of your business. If the project is carried out across two or more areas, the approval of the prefectural governor is required. In addition, wide-ranging businesses and businesses without restrictions on location are approved by the Minister of Health, Labor and Welfare.

Once approved, apply for registration at the registry office that has jurisdiction over the location of the corporate office. The documents required for establishment are as follows.

After registration is completed, the first board meeting will be held and councilors will be elected. The council is required to appoint directors and auditors and pass resolutions on important matters.

In addition, there is an audit to confirm the actual state of operation even after the start of the business. There are general audits and special audits, and general audits are carried out at regular intervals after formulating an implementation plan. Special audits are conducted from time to time when there are problems with business operations.

Social welfare corporations have many aspects that are different from corporations as corporations that conduct social welfare projects. Although there are aspects that are more favorable than joint-stock companies, there are also disadvantages such as being screened under stricter conditions and being supervised by management.

Depending on the type of industry you want to work in, you may want to consider the options of social welfare corporations after understanding the advantages and disadvantages. You can only become a social welfare corporation if you mainly engage in social welfare projects, but the preferential treatment is very attractive.

The Founding Notebook (booklet version) contains necessary information after starting a business, such as fundraising and tax saving. Please use it for support during the period immediately after starting a business.

Related articleWhat is a “social entrepreneur” that has been attracting attention in recent years? Explanation of its meaning, the purpose of starting a business, and the difference from a normal start-up About the necessary preparations before applying for permission for nursing care and disability welfare businesses(Edited by Founder Handbook Editorial Department)

Articles that everyone is reading in this category 1st Company Establishment [Latest Version] Textbook on Establishing a Limited Liability Company | Thorough Explanation of the Flow, Cost, Advantages and Disadvantages of Establishment 2nd Company Establishment [Saved Version] First NPO Establishment | Advantages , establishment cost, period, conditions? 3rd Place Company Establishment [Saved version] The founder of the founding notebook, Okubo, explains in detail the "all procedures" and flow of establishing a company!