Two reasons for the "explosion" of import prices, will companies pass on? Series: Yukio Noguchi's Essence of Digital Innovation | FinTech Journal

Information media for the future of finance

Powered by

Login

E-mail newsletter registration

Business + IT

Sales StrategyCost reductionOrganizational reformProduction / manufacturingcrisis managementcomplianceEnergy saving and environmental friendlinessBy industry / scaleCore systemInformation systemOperation managementSecuritynetworkmobilehardwaredevelopmentEvents / seminars

Special

Business + IT

Two reasons for the "explosion" of import prices, will companies pass on?

Series: Yukio Noguchi's essence of digital innovation

Currently, import prices are soaring. Soaring crude oil prices and a weak yen. There is one criterion for how much a company will pass this on to the end consumer. Here, I would like to propose a break from the yen depreciation policy.

Written by Yukio Noguchi

Written by Yukio Noguchi

Born in Tokyo in 1940. Graduated from the Faculty of Engineering, University of Tokyo in 1963. In 1964, he joined the Ministry of Finance. In 1972, he received his Ph.D. in Economics from Yale University. He has served as a professor at Hitotsubashi University, a professor at the University of Tokyo (Director of the Center for Advanced Economic Engineering), a visiting professor at Stanford University, and a professor at the Graduate School of Finance, Waseda University. He is an emeritus professor at Hitotsubashi University. note account: https://note.com/yukionoguchi Twitter account: @ yukionoguchi10 Noguchi homepage: https://www.noguchi.co.jp/

- Two reasons why import prices have risen abnormally

- Trends in consumer prices in Japan are determined by import prices

- Temporary or permanent decisions affect pass-through

- Yen purchasing power is at historically low levels

- Yen depreciation weakens Japanese economy

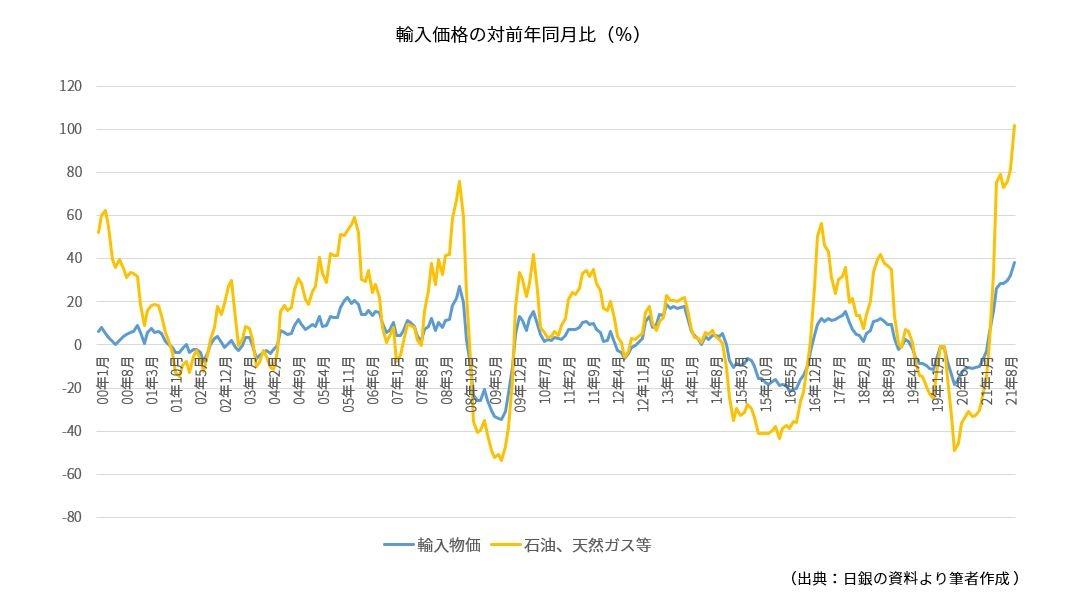

Two reasons why import prices have risen abnormally

Import prices are rising significantly now. The year-on-year rate of change exceeded 30% in August 2021 and reached 44% in November. It has been soaring since the end of 1979 to 1980 when it exceeded 80%. As shown in the figure below, after 2000, the rate of increase increased in 2006, 2008, 2013, and 17-19, but the rate of increase is higher than that time. There are two causes for soaring import prices. The first is the rise in crude oil prices. In 2019, it was in the $ 50 range per barrel, and in 20 it fell to below $ 20 at one point due to the influence of the new corona. However, it returned to $ 50 at the end of the year due to expectations of recovery from Corona, and continued to rise, surpassing $ 80 in October and November 2021. It's about $ 82 now. The second factor is the depreciation of the yen. In 2019, it was about 105 yen to 0110 yen to the dollar, but the yen appreciated in 2020 and reached the 103 yen level at the end of the year. However, the yen depreciated from the beginning of 2009 and reached the 110 yen level in the summer. After that, it fell further and is now around 114 yen. This is because the United States is trying to break away from monetary easing, and as a result, long-term interest rates in the United States are rising, while interest rates in Japan are almost unchanged, so the interest rate differential between Japan and the United States widens. Because it is. Crude oil prices also rose around 2012. At that time, it was about $ 100 a barrel. However, since the exchange rate was strong at this time, the impact on domestic prices was mitigated.Trends in consumer prices in Japan are determined by import prices

How will the rise in import prices seen above affect consumer prices in the future? Until now, consumer prices in Japan have been greatly influenced by trends in import prices. Japan's consumer price index (total excluding fresh food, 2020 = 100) was around 30 at the beginning of 1970. Due to the oil shock, it reached about 70 at the beginning of 1980. The index exceeded 90 in September 1999. But after that, it's almost constant. Compared to the same month of the previous year, it was about 5% in 1972, exceeded 10% in 1973, and exceeded 20% in 1974. However, it decreased to about 5% after 1980 and became about 2% after 1985. Since around 1995, the rate of increase has been almost zero. What is happening to consumer prices under the first soaring import prices? The year-on-year comparison of the comprehensive index excluding fresh food was 0.0% in August, 0.1% in September and 0.1% in October, but it was 0.5% in November. As far as we can see, soaring import prices do not seem to have a significant impact on consumer prices. However, this is largely due to the reduction in mobile phone calling charges. In November, it contributed minus 1.48% to consumer prices. Without this, the consumer price index would have risen to 1.98% in November. In other words, it can be said that it has already had a considerable impact on consumer prices. [Next page] Judgment of temporary or permanent influences pass-throughTopics

To List

IT introduction support information

PR

SB Creative Co., Ltd.

By registering as a business + IT member, you can subscribe to member-only content and e-mail newsletters, and invite you to special seminars!